Quick Links

Government Agencies and Programs

Canada Revenue Agency

Canada Revenue Agency UHT (Underused Housing Tax)

UHT (Underused Housing Tax) CPP Application (Canada Pension Plan)

CPP Application (Canada Pension Plan) OAS (Old Age Security)

OAS (Old Age Security) CCB (Canada Child Benefit)

CCB (Canada Child Benefit) WCB Alberta (Workers Compensation Board)

WCB Alberta (Workers Compensation Board) Alberta Labour Employment Standards

Alberta Labour Employment Standards Alberta Seniors Benefit Calculator

Alberta Seniors Benefit Calculator Canada Disability Benefit

Canada Disability Benefit Disability Tax Credit

Disability Tax Credit Canada Dental Care Program

Canada Dental Care Program

Banks & Lending

ATB Financial

ATB Financial CIBC (Canadian Imperial Bank of Commerce)

CIBC (Canadian Imperial Bank of Commerce) VCU (Vision Credit Union)

VCU (Vision Credit Union) AFSC (Agriculture Financial Services Corporation)

AFSC (Agriculture Financial Services Corporation)  FCC (Farm Credit Canada)

FCC (Farm Credit Canada)

Local

Helpful Tips

Please Don't Ignore CRA Letters

If you receive a letter from CRA, read it to see if CRA is requesting information, adjusting your taxes or confirming what you filed. If you don't understand what the letter is saying, bring it into our office and we would be happy to help you.

Prevent Additional Tax Charges

From July to November, you may receive a letter from CRA requesting more information from your tax return. If you receive a letter, please bring it into our office PROMPTLY so we can respond. If we don't respond within 30 days, CRA will adjust your tax return and you will have a balance owing.

Avoid Making Payments Twice to Government

If you have received a GST or Income Tax notice of assessment that you thought was paid, it may be. Your return is e-filed and reaches CRA almost immediately, whereas your payment takes time to process. That means the bill was likely mailed before your payment was applied. Please verify that the amount is paid before attempting to pay again.

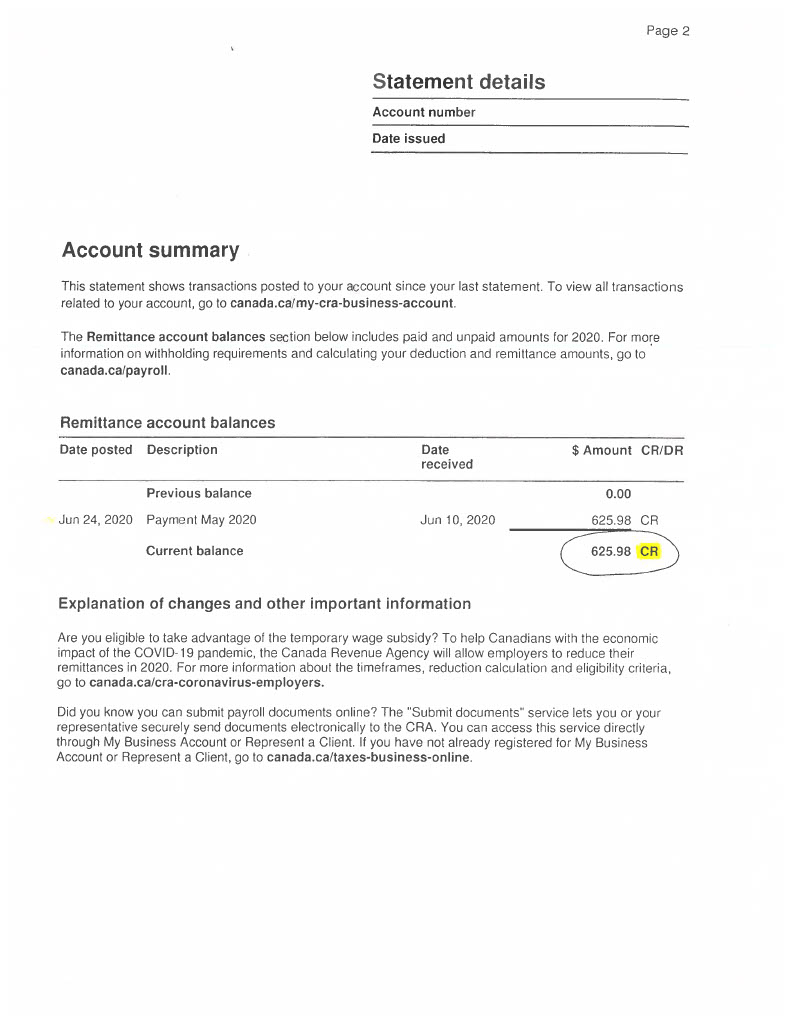

Source Deduction Forms - Credit Balance

Note that a source deductions form with a credit balance (marked as 'CR' as shown below) does not need to be paid to CRA. A credit amount shows what you have already paid in for source deductions for prior months.

ph 780 928 3277 email FAL96@telusplanet.net Friesen Accounting (1996) Ltd. 10013 -101 Ave Box 330 La Crete AB T0H 2H0